Blevins Franks

High-net-worth client wealth management · Cross-border asset allocation · Quantitative strategy optimization

Business IntroductionBLEVINS FRANKS is a leading European wealth management company dedicated to providing high-net-worth clients, family offices, and institutional clients with comprehensive asset allocation, portfolio optimization, and quantitative analysis services.

The company is headquartered in London (UK) and has branches in New York (USA) and Málaga (Spain). A new branch is currently being prepared for opening in Valencia. The company is committed to combining high-quality resources from international financial markets with local expertise to design sound and sustainable long-term investment strategies for its clients.

BLEVINS FRANKS is a leading European cross-border wealth management firm, specializing in providing systematic, full-cycle financial planning and asset allocation solutions for high-net-worth individuals, family offices, and international corporations.

Leveraging our compliance network covering key regions in Europe and the Americas, our team has developed unique strengths in areas such as taxation, investment management, family trusts, and cross-border asset protection, enabling us to build secure, transparent, and sustainable wealth structures for our clients.

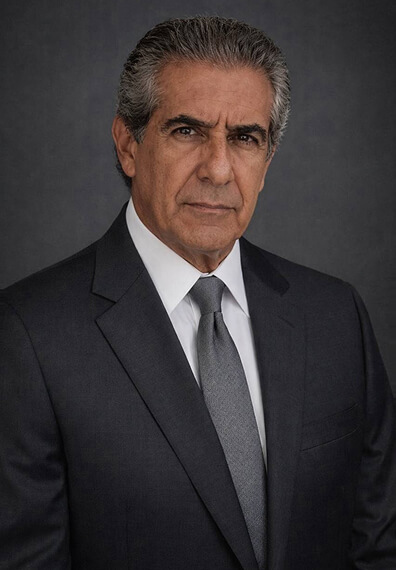

Under the leadership of CEO Professor Javier Antonio Serrano, the company has further strengthened its strategy system supported by institutional-level research, providing clients with highly customized cross-border asset solutions through a data-driven investment framework, regional tax system analysis models, and long-term collaborative experience with European regulatory agencies.

CEO Profile

To become the world's most influential cross-border wealth management and asset allocation institution, leading the professionalization, internationalization, and transparency of the wealth management industry.

Through rigorous risk management, scientific asset allocation, and forward-looking macroeconomic research, to help clients protect and grow their assets, achieving steady long-term wealth growth.